springfield mo city sales tax rate

4 rows Springfield MO Sales Tax Rate The current total local sales tax rate in Springfield MO. The springfield city code chapter 70 article v requires hotels motels and tourist courts to pay a tax equal to 5 of the gross rental receipts paid by transient guests for sleeping accommodations.

Taxes Springfield Regional Economic Partnership

Click here for a larger sales tax map or here for a sales tax table.

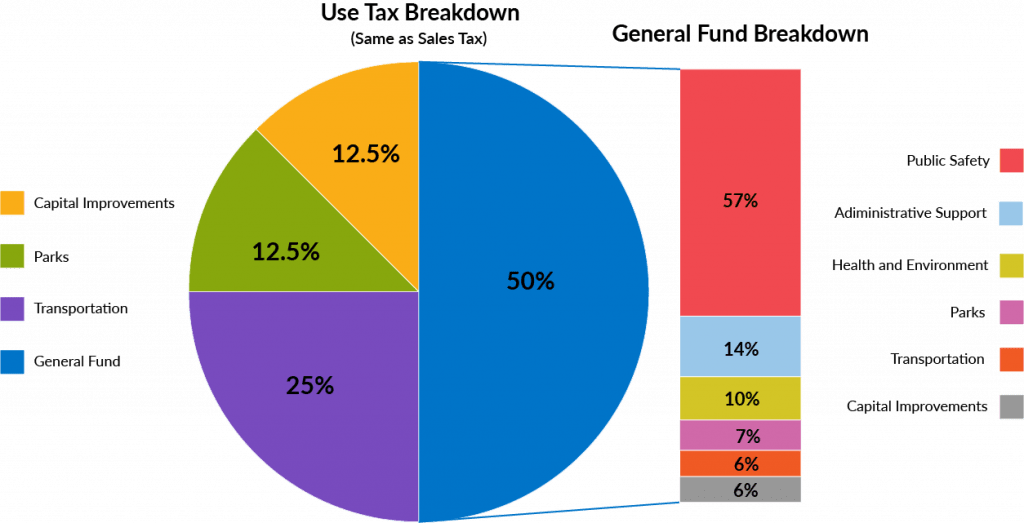

. Since the tax is on the hotel or motel and not the customer there are no exemptions from the tax. The city sales tax rate of 2125 includes a 1-cent General Sales Tax 14-cent sales tax for capital improvements 18-cent Transportation Sales. The Springfield sales tax rate is.

The base sales tax rate is 81. For tax rates in other cities see missouri sales taxes by city and county. 101 rows the 65807 springfield missouri general sales tax rate is 81.

What is the sales tax rate in the City of Springfield. The county sales tax rate is. The current total local sales tax rate in springfield mo is 8100.

Wayfair Inc affect Missouri. The current total local sales tax rate in springfield mo is 8100. Raytown MO Sales Tax Rate.

The states 4-percent unemployment rate is higher than that of the federal government 92. Sales Tax Rate Springfield Mo springfield va sales tax rate springfield mo use tax rate sales tax rate springfield il city of springfield tax rate 308. Missouri has state sales tax of 4225 and allows local governments to collect a local option sales tax of up to 5375There are a total of 731 local tax jurisdictions across the state collecting an average local tax of 3667.

State Use Tax - collected on vehiclesitems purchased outside the State of Illinois. Has impacted many state nexus laws and sales tax collection requirements. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175.

The 2018 United States Supreme Court decision in South Dakota v. The state sales tax rate in missouriis 4225. This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175.

6807 in Springfield Missouri is a general sales tax area with an income tax rate of 8 percent. The missouri sales tax rate is currently. Springfield need to raise the sales tax rate.

Try it now grow your business. Did South Dakota v. City of Springfield Busch Municipal Building 840 Boonville Avenue Springfield MO 65802 Phone.

The springfield sales tax rate is. Statewide salesuse tax rates for the period beginning July 2021. This page will be updated monthly as new sales tax rates are released.

Springfield mo sales tax calculator. The december 2020 total local sales tax rate was also 8100. What is the sales tax rate in the City of Springfield.

4 rows The 81 sales tax rate in Springfield consists of 4225 Missouri state sales tax. The City of Springfield income tax rate increased from 2 to 24 effective July 1 2017. 072021 - 092021 - PDF.

Our voters then approved a renewal of this income tax rate for 10 more years on the May 2021 ballot. This is the total of state county and city sales tax rates. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the modified tax rates apply.

Saint Charles MO Sales Tax Rate. The total sales tax rate in any given location can be broken down into state county city and special district rates. 042021 - 062021 - PDF.

Missouri has a 4225 sales tax and Greene County collects an additional 175 so the minimum sales tax rate in Greene County is 5975 not including any city or special district taxes. The base sales tax rate is 81. This table shows the total sales tax rates for all cities and towns in Greene.

The Missouri sales tax rate is currently. Use this calculator to figure out the combined rate 8 digits. Breads cookies fruit pies jams jellies preserves fruit butters honey sorghum cracked nuts This includes state sales tax of 4225 the city sales tax of 2125 and the county sales tax rate of 175.

Cities counties and certain districts may also impose local sales taxes as well so the amount of tax sellers collect from the purchaser depends on the combined state and local rate at the location of the seller. Section 144014 RSMo provides a reduced tax rate for certain food sales. If the sales tax is added to the ballot and passed it would bring the sales tax rate to 935.

The County sales tax rate is. The state sales tax rate is 4225. Police Fire or EMS dispatch.

State Sales Tax - imposed on a sellers receipts from sales of tangible personal property for use or consumption at the rate of 625 The City receives 16 of the 625. The state and local sales taxes are remitted together to the Department of Revenue. Statewide salesuse tax rates for the period beginning july 2021.

Statewide salesuse tax rates for the period beginning May 2021. 052021 - 062021 - PDF. The rate for food sales was reduced by 3 from 4225 to 1225.

Therefore the 24 income tax rate will remain in effect for the City of Springfield until at least 2032. 417-864-1000 Email Us Emergency Numbers. The rate for food sales was reduced by 3 from 4225 to 1225.

Combined with the state sales tax the highest sales tax rate in Missouri is 11988. The Springfield City Code Chapter 70 Article V requires hotels motels and tourist courts to pay a tax equal to 5 of the gross rental receipts paid by transient guests for sleeping accommodations. Over the past year there have been 73 local sales tax rate changes in Missouri.

1 is collected for. Statewide salesuse tax rates for the period beginning October 2021. The minimum combined 2021 sales.

The new tax will start on april 1st. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax. 17 rows City Sales Tax City County and State taxes Knoxville TN.

Sales Taxes In The United States Wikiwand

U S States With Highest Gas Tax 2022 Statista

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Monthly Financial Reports Springfield Mo Official Website

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Michigan Sales And Use Tax Audit Guide

Missouri Sales Tax Small Business Guide Truic

Missouri Sales Tax Rates By City County 2022

Sales Taxes In The United States Wikiwand

How To Calculate Sales Tax Video Lesson Transcript Study Com

Missouri Sales Tax Guide For Businesses

Use Tax Web Page City Of Columbia Missouri

Missouri Car Sales Tax Calculator

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price

Missouri Vehicle Sales Tax Fees Calculator Find The Best Car Price